More About The 5 Stages Of Team Development – Indeed

Don`t try to avoid dispute. It is normal and can be healthy. If everyone in your team believes as well as acts the exact same, after that why do you have a team? The advantage of functioning in a team is that you have access to diverse experiences, abilities, and opinions that aren`t feasible alone (ai).

However, don`t take one. Look for commonalities. Each person wants to get to the end goal. When problems are solved, it can improve existing processes and bond participants together. 5. Remind group participants to listen. Each individual in your team holds some worth, or else they would not be there? Remind your team to pay attention per individual`s insight.

Hold conceptualizing sessions. Document every idea that is offered, despite how absurd it sounds. A few of the greatest entrepreneurs as well as inventors have actually had stopped working firms as well as ill-conceived ideas. For every single brilliant idea, there are 100 terrible ones. Encouraging your group to share their concepts and opinions is the crucial to locating the “concepts”.

Get This Report on Team Development Programs – Training Wheels

End each conference with informative and also useful responses that enhances the team process. When you lead a team, component of your responsibility is to observe. Research study exactly how the team functions as an unit and also separately. What are they doing well? What do they need to improve? Offer individual responses in individually conferences.

Prepare individuals for success in teams

Don`t scold teams for their errors as well as failures, without showing them what went wrong. Don`t mention problems without supplying solutions and suggestions (ai). It is necessary to provide criticism in such a way that empowers them to do far better. Nobody likes an Adverse Nancy or Debbie Drag either. Inform groups what they are doing right along with what they need to enhance.

Everyone plays a component as well as has something to contribute. When someone stops working to complete a job, the remainder of the team endures. It is necessary to impart this sense of responsibility in a group. You might still require to remind as well as encourage members to be effective. This is one more area where time tracking can aid.

See This Report on The Five Behaviors® Team Development – Disc Profile

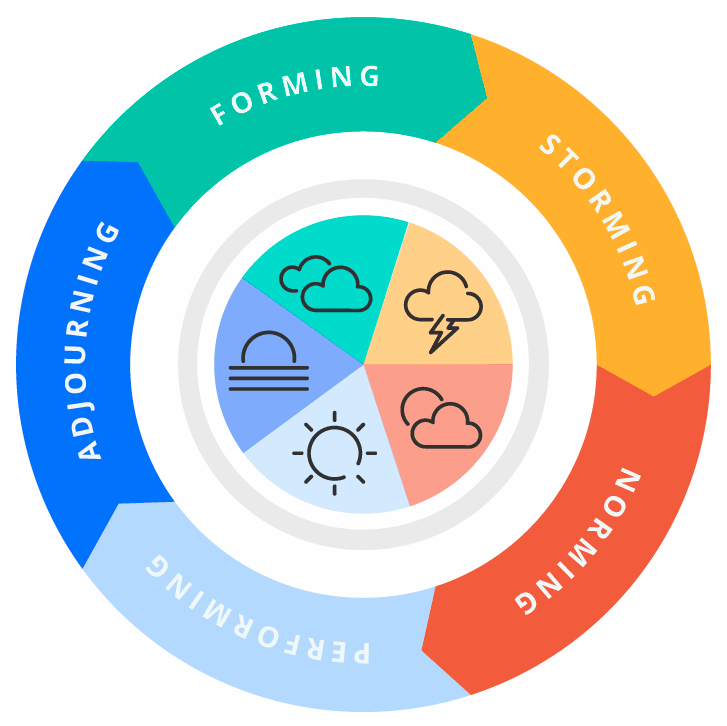

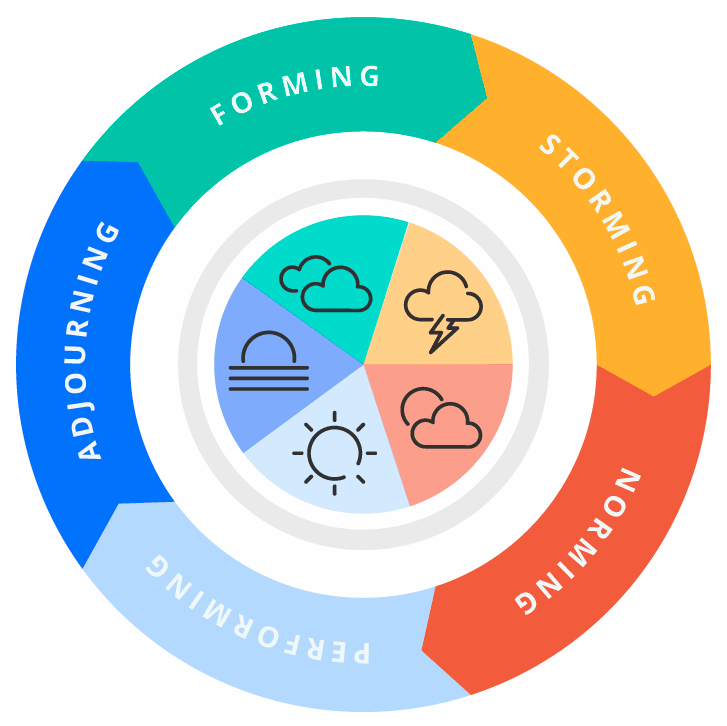

Building a team isn`t simple. It is a process. Understanding each phase of growth can aid you produce dream teams that provide amazing results.

The Only Guide for Tuckman`s Stages Of Group Development – West Chester …

The Only Guide for Tuckman`s Stages Of Group Development – West Chester …

Reliable leaders know, you`re just comparable to individuals you have around you. With this in mind, great leaders know that creating their team is a crucial part of their function. While numerous leaders are mindful of the notion of team development, it`s crucial to comprehend the core concepts that enter into developing a team, and also what proper implementation can indicate for forward-thinking management.

It`s the role of efficient leaders to understand just how to develop these individual staminas as well as direct them to realise the results that exist in wait within their cumulative possibility. Regardless of what sort of group you`re forming, there will be a specified collection of advancement stages each leader will certainly require to progress with.

The Definitive Guide for 3.2 Implications Of The Team Development Model – How Teams …

Leaders require to play an extra energetic duty to choose responsibilities as well as aid establish goals. They likewise need to be prepared for this stage to be a lengthy one; it can take a while for employee to get to understand each other as well as really feel comfortable functioning with each other. Once employee discover their feet, they`ll relocate onto the following phase.

As distinctions and conflicts occur, many groups falter or stop working at this stage. For leaders, this phase examinations your ability to manage disputes as well as lead by instance. Leaders require to motivate employee to see past the arising disputes and also redouble on the task at hand. At this stage, your team starts to strike their stride.

Realising that they`re in this with each other, your group has the ability to take pleasure in as well as celebrate one an additional`s differences and toughness. As a leader, the battle below is keeping your team on track and focused. By encouraging a feeling of `we` rather than `I`, leaders are able to solidify the bond that has been established amongst the team and also concentrate it towards achieving greater results.

The Only Guide for The Stages Of Project Team Development – Velopi

Some staff member battle with the concept of regular modification, while others see it as an opportunity to go on as well as learn new abilities. In both instances, leaders play an important role in assisting in opportunities for reflection and celebration. Solid team development is an important aspect of any kind of successful workplace or organisation.

Poor interaction can lead to reduced morale and missed possibilities for understanding and also growth. With proper advancement, communication becomes a core aspect of the makeup of the group, enhancing its capability to introduce and create. Boosted performance: Productive teams attain objectives. While the act of team structure has many benefits, its core objective is to allow individuals to function together to create something fantastic.

Groups are coming to be a key tool for organizing operate in today`s business globe. Teams have the prospective to immediately amass, arrange, relocate, and also distribute. Teams are an effective device of worker motivation. It is vital to consider the fact that teams establish as well as get mature over a time period.

The Only Guide for Team Development: Forming Storming Norming And Performing

Stage 1: Forming Throughout this stage, team members may fear as well as embrace wait-and-see mindset. They will be official towards each various other. There would be no clear idea of goals or expectations. They might not be certain why they are there. This is the phase where the team needs to create its own charter or mission declaration in addition to clarify goals.

By doing this the group will certainly have the ability to develop borders as well as determine what is anticipated. Employee will certainly get to recognize each other doing non-conflict laden job. This develops the commitment in the direction of one larger objective. Thus, during the forming stage, the employee remain in procedure of understanding each other and also obtaining at ease with them.

Hence, during the storming phase, the group participants start showing their real designs. They start getting impatient. They attempt to penetrate into each other`s location, bring about irritability and stress. Control becomes the key problem during this stage. Phase 3: Norming This stage is when people begin to acknowledge methods which they are alike.

Examine This Report on The 5 Stages Of Group Development Explained – Clockify Blog

For this reason, they often tend to obtain even more social and might forget their focus in favour of having an excellent time. This is the time to assist with training if applicable. It ends up being essential to urge them in order to feel comfortable with each various other and with systems. Likewise, the team requires to stay concentrated on objective.

turnkeycoachingsolutions.com

There is higher involvement of staff member. There is a greater “we” feeling instead than “I” feeling. Stage 4: Performing This phase is when group members are educated, qualified, along with able to do their own problem-solving. Currently, means need to be looked at in order to challenge them in addition to establish them.

Profile assessment: build a cohesive team

The participants recognize their duties as well as responsibilities. They would certainly call for more input in processes. The participants would be self-motivated along with self-trained. Hence, their efforts require to be recognised. Development has to be motivated. This is done by giving new obstacles to the team. Therefore, teams at the stage of performing are self-controlling, useful, loyal along with productive.